On the subject of guarding yourself, Your loved ones, or your company, the most effective equipment at your disposal is a comprehensive insurance policy Option. Insurance policies solutions are like a security Internet inside the unpredictable circus of daily life, presenting you the assurance that, it doesn't matter what occurs, you won't need to deal with fiscal wreck. But what precisely will make up a great insurance policy Alternative? And How are you going to make sure the a single you end up picking fits your preferences flawlessly? Permit’s dive into The subject and investigate all the things you need to know.

At its core, an insurance plan Alternative is just a way to transfer the danger of economic loss from you to an insurance provider. Within a globe where issues can go wrong in An immediate—whether or not as a result of incidents, health concerns, assets hurt, or surprising gatherings—a good insurance policy Alternative can defend you from the mountain of worry. Image it similar to a shield that shields your finances when issues don’t go as prepared.

7 Easy Facts About Insurance Solution Shown

But not all insurance policies solutions are the identical. You can find a great number of options on the market, Every single tailored to diverse needs. Do you need health insurance coverage, home insurance coverage, existence coverage, Or even a combination of all three? The answer will depend on your situation. The true secret to receiving the most out of the insurance plan solution lies in comprehending what coverage you require And just how Just about every plan operates to satisfy Those people requires.

But not all insurance policies solutions are the identical. You can find a great number of options on the market, Every single tailored to diverse needs. Do you need health insurance coverage, home insurance coverage, existence coverage, Or even a combination of all three? The answer will depend on your situation. The true secret to receiving the most out of the insurance plan solution lies in comprehending what coverage you require And just how Just about every plan operates to satisfy Those people requires.Another thing to take into consideration is whether or not you want a far more common or specialized insurance Option. Some people might Opt for the simplest option—a standard, one-sizing-matches-all program which offers normal protection. This might be ample for somebody just starting out or somebody that doesn’t have lots of property to protect. However, extra specialised remedies could possibly be needed for Individuals who have distinct demands, like entrepreneurs who call for professional insurance plan or an individual with unique wellbeing desires that need far more personalized protection.

So, How would you go about deciding on the appropriate Alternative? Step one is to evaluate your preferences. Commence by inquiring your self, “What am I seeking to shield?” Are you currently looking for protection for the wellness, residence, or family members? Comprehending your priorities will allow you to slender down your possibilities and ensure that you choose an coverage Answer that offers you peace of mind without the need of purchasing pointless coverage.

1 frequent oversight individuals make When picking an insurance coverage Resolution is assuming that the cheapest selection is the greatest. When saving cash is very important, choosing the minimum costly insurance coverage coverage could leave you underinsured. Consider purchasing a winter coat on sale—It really is cheap, nonetheless it isn't going to continue to keep you heat from the snow. Exactly the same logic applies to insurance: you don’t want to Slash corners In terms of guarding what matters most to you personally.

An important Think about determining on the right coverage solution is understanding the different sorts of coverage. Wellbeing insurance policy, one example is, is made to assist with The prices of health-related treatment. But within just this category, you’ll locate selections like specific or family protection, high-deductible programs, plus more. Each individual of such programs delivers unique amounts of protection, so it’s crucial that you decide one that aligns with your healthcare demands and finances.

In regards to residence or auto insurance policy, the Tale is analogous. Would you individual a car or lease a home? The type of protection you require will fluctuate based upon your situation. Homeowners may well want procedures that protect everything from hearth damage to theft, even though renters could only want protection for private possessions. In the meantime, in case you personal a company, you’ll have to have industrial insurance coverage to protect both equally your Bodily property along with your employees. In a nutshell, every single insurance solution is made with a specific want in mind.

A different essential facet of an insurance policies Option may be the assert method. How effortless can it be to file a assert if one thing goes Incorrect? Ideally, you'd like an insurance company with an easy, stress-totally free course of action that doesn’t include tension whenever you need support one of the most. Consider it like a friend who assists you clear up the mess when things disintegrate, in lieu of somebody who would make the endeavor tougher than it ought to be.

Picking out the suitable insurance plan Remedy is centered on being familiar with the wonderful print. Occasionally, guidelines can feel overwhelming with all their stipulations. But You should not shy clear of reading through them. What’s bundled? What’s excluded? Are there any hidden service fees? Inquire queries and be certain you recognize what exactly you're signing up for prior to committing.

An normally-overlooked feature of many insurance policy solutions is the flexibleness they supply. As your daily life alterations, your coverage demands may evolve as well. Perhaps you can get married, have youngsters, start a company, or buy a property. You will need an coverage Remedy that could regulate to People alterations. Some policies let you increase or lower coverage, while others could possibly even help you add new attributes like incapacity or accidental Dying coverage.

An additional matter to think about is the reputation from the insurance coverage company. An insurance company which has a reliable standing is more likely to be honest and trusted whenever you have to have them most. You don't want to discover that the insurance provider is gradual to pay for statements or hard to talk to when catastrophe strikes. So, look at consumer assessments, ask for suggestions, and perform some study prior to making your ultimate decision.

Insurance plan alternatives are all about stability. You don’t choose to underinsure yourself, leaving gaps that would set you back afterwards, but In addition, you don’t choose to overpay for avoidable coverage. Acquiring that sweet location involving price and security is critical. From time to time, What this means is dealing with an agent who can help you tailor your plan to fulfill your requirements and spending budget.

A good deal of people believe insurance is nearly the apparent things—health and fitness, household, and car. But insurance options might also increase to much less obvious regions, like life insurance policies or small business interruption insurance coverage. Lifetime coverage guarantees your loved ones are monetarily protected if a thing happens to you, though business enterprise interruption insurance coverage protects your organization in the economic outcomes of surprising closures or disruptions.

The smart Trick of Insurance Solution That Nobody is Discussing

The Main Principles Of Insurance Solution

From time to time, an insurance policies Alternative isn’t nearly preserving property. It also can offer financial relief in the form of cash flow replacement. This is especially vital in the situation of incapacity insurance policy, which allows exchange misplaced income for anyone who is unable to operate as a consequence of an harm or disease. Having this protection net in place can be quite a lifesaver if you're unable to do the job for an prolonged period.

For those who’re a business owner, insurance policies methods are a lot more essential. Not just do you must shield your Bodily property, but you also will need to shield your workers and ensure your company can continue on functioning during the confront of setbacks. Commercial coverage can cover everything from house damage to liability promises, and the appropriate insurance plan Option can be the difference between being afloat or sinking less than economical strain.

When contemplating your insurance policy Alternative, usually remember that you're not on your own in this final decision. Insurance policies agents are there that can help guide you, make clear your options, and solution any thoughts you could have. They will let you navigate throughout the complexities of various guidelines and make certain that you discover the ideal a single for your one of a kind problem. You should not wait to achieve out for support if you want insurance solution it.

Eventually, the most effective coverage Alternative to suit your needs would be the one which aligns with your needs, spending plan, and Life-style. It truly is a personalised final decision, and the greater informed you are, the higher your likelihood of getting a coverage that actually guards what matters most. So choose your time and efforts, do your study, and pick sensibly. All things considered, this is regarding your foreseeable future safety.

In summary, deciding on the suitable insurance Remedy is about understanding your preferences, Discovering the several solutions readily available, and finding a service provider you can trust. Irrespective of whether It really is wellness insurance coverage, residence insurance coverage, automobile insurance, or even existence insurance coverage, a perfectly-picked out plan can be the distinction between thriving and merely surviving. Secure by yourself, your family, as well as your long run with the correct insurance plan Alternative, and relaxation easy recognizing that you are ready for regardless of what lifetime throws your way.

Shaun Weiss Then & Now!

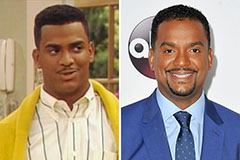

Shaun Weiss Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!